nassau county property tax rate 2020

3 discount if paid in the month of December. Bring all of the information you would like considered.

Video As The Year Winds Down Signs Of An Economic Slowdown Video Signs Wind

Are You Confused About Your Property Taxes.

. If you are able please utilize our online application to file for homestead exemption. On March 23 2020 the Nassau County Legislature passed the Reassessment Phase-In Act of 2020 RPIA formerly known as the Taxpayer Protection Plan. Delinquent School Taxes are collected by the Treasurers Office beginning June 1st and delinquent General Taxes are collected by the Treasurers Office beginning September 1st.

What is the property tax rate for Nassau County. Request Your Tax Grievance Form Today. How to Challenge Your Assessment.

Processing applications for property tax exemption and the Basic and Enhanced STAR programs for qualifying Nassau County homeowners. This viewer contains a set of property maps of every parcel within the County of Nassau. Nassau County has one of the highest.

The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes. Their first tax bill for for 2020-21. This office is committed to.

Ad Authorize Maidenbaum To Challenge Your Nassau County Property Tax Assessment Now. Request Your Tax Grievance Form Today. Nassau County Department of Assessment 516 571.

However by law the program expired after. How much are taxes in Nassau County. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

Nassau County collects on average 179 of a propertys assessed fair market value as property tax. Are You Confused About Your Property Taxes. Ad Authorize Maidenbaum To Challenge Your Nassau County Property Tax Assessment Now.

Updated information on STAR and property tax relief checks Eligible homeowners received property tax relief checks in 2017 2018 and 2019. For over 10 months County Executive Curran has urged the Nassau County Legislature to call for a vote and finally approve the plan. The public information contained herein is furnished as a public service by Nassau County for use.

Nassau County collects on average 179 of a propertys assessed. Nassau County Annual Tax Lien Sale - 2022. Property Taxes for 63 Nassau Boulevard West Hempstead.

If you believe the assessment is inaccurate you may appeal by. Schedule a Physical Inspection of Your Property If. Contact the Property Appraisers Office.

Schedule an appointment to come in and talk to an appraiser. What are the property taxes in Nassau County NY. Nassau County Property Appraiser.

Access property records Access real properties. Tax rates in each county are based on combination of levies for county city town village school district and certain special district. Assessment Challenge Forms Instructions.

You can visit their website for more information at Nassau County Property Appraiser. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Last summer the County posted a hypothetical.

4 discount if paid in the month of November. Access detailed property tax data for 63 Nassau Boulevard West Hempstead NY 11552. On February 15 th 2022 the Nassau County Treasurer will sell at public on-line auction the tax liens on certain real estate unless the owner.

What the RPIA Does. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Prior to visiting one of our.

36724 for school Nassau County and Oyster Bay Town property taxes What they paid this year after receiving the exemption. The Nassau County Department of Assessment determines a tentative assessment for every property as of January 3 2022. The deadline to file is March 1 2022.

This is the total.

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Explore Our Example Of Real Estate Investment Analysis Template For Free Real Estate Investing Investment Analysis Spreadsheet Template

Mortgage Rates Hit Another Record Low But Homes Are Still Less Affordable Mortgage Rates Home Buying Mortgage

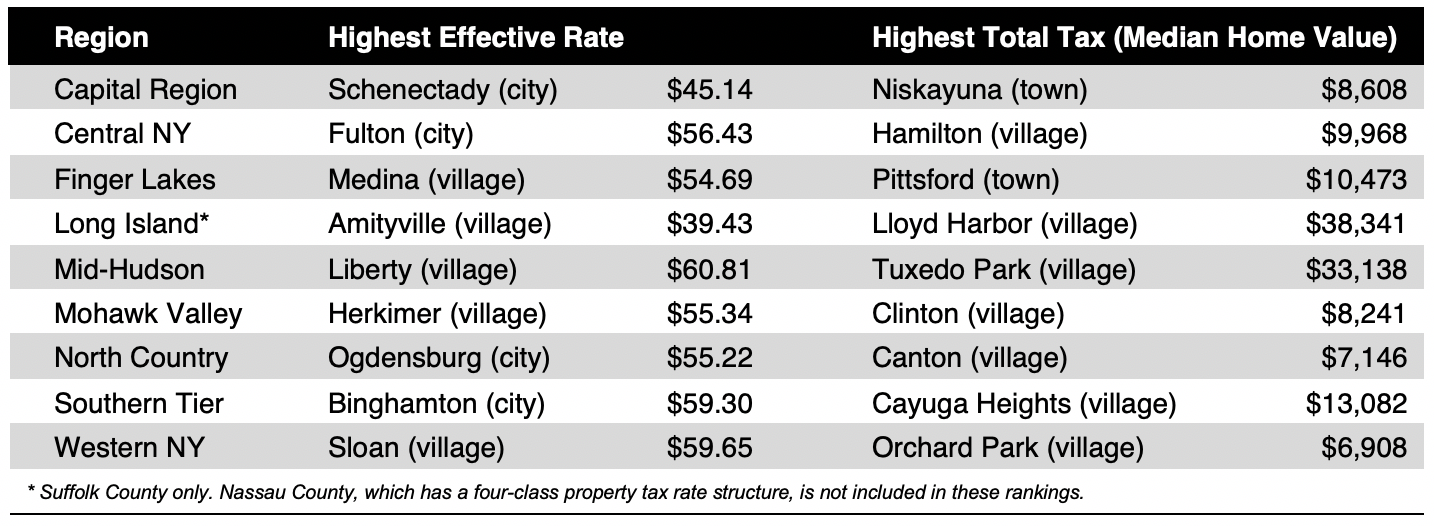

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

New York Property Tax Calculator 2020 Empire Center For Public Policy

Property Taxes In Nassau County Suffolk County

95026 Paso Robles Court In 2020 Property Real Estate Amelia Island

All The Nassau County Property Tax Exemptions You Should Know About

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Pin On Mortgage And Finance Tips

Property Taxes In Nassau County Suffolk County

1 25 Million Homes In Maine Texas And New York Maine House 1871 House House Prices

Property Taxes In Nassau County Suffolk County

Nassau County Ny Property Tax Search And Records Propertyshark

Compare Your Property Taxes Empire Center For Public Policy

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Purchase Your Next Investment Property At Auction With An Ira Investing Investment Property Real Estate Marketing